Equifax Sued for Not Investigating Disputed Inquiries on Credit Reports

Equifax Sued In Another Class Action Because Of Its Systemic Failure To Investigate Consumer Disputes Of Unauthorized Or Fraudulent Inquiries Appearing On Consumers’ Credit Reports

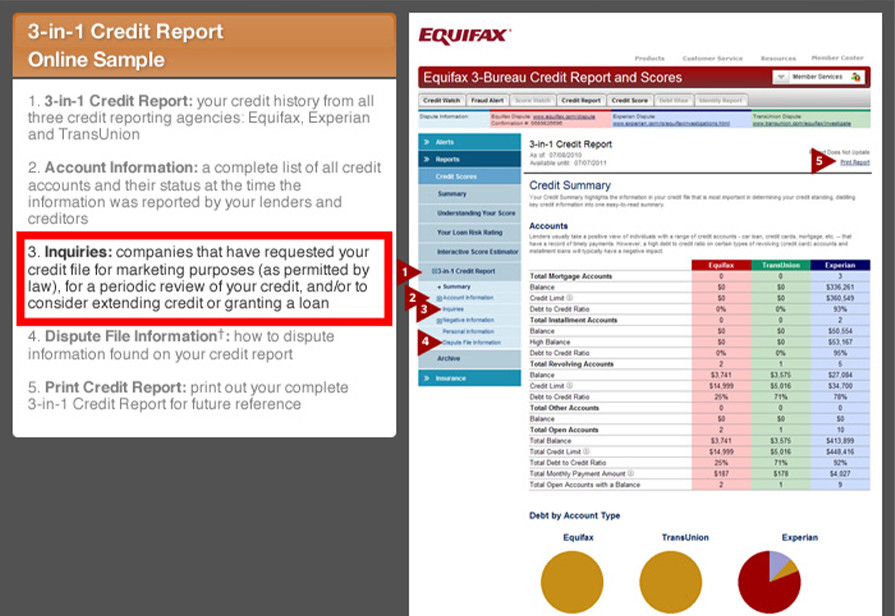

Inquiry information is included on a credit report because it is part of a consumer’s credit history. Inquiries identify the persons and companies from whom the consumer sought credit and how often the consumer did so. Inquiries generally have a negative impact upon a consumer’s credit score because scoring programs view each inquiry as an application for credit, and a consumer who makes multiple applications is considered a greater risk than a consumer who does not.

Equifax receives hundreds of thousands of disputes of inquiry information each year in which consumers state that Equifax provided a consumer report about them to a third party with which the consumer neither sought credit nor authorized to obtain a consumer report about them. Despite this voluminous evidence, Equifax continues to provide credit reports to the companies about which consumers have repeatedly complained.

The Class Action Complaint claims that Equifax does not investigate these types of disputes or delete the inquiries, and in fact continues to report those unauthorized inquiries to new third parties with whom consumers legitimately seek credit or other business relationships. The Class Action Complaint further alleges that “Equifax’s procedures are clearly broken” in this respect.

The suit was brought by Francis Mailman Soumilas, P.C., found at consumerlawfirm.com, and its co-counsel in federal court the Eastern District of New York.

Checking Your Credit Report Annually

You can check your credit report for free each year. Go to AnnualCreditReport.com and get your credit reports from the three large credit bureaus, Equifax, TransUnion, and Experian.

Monitoring your credit reports annually is important to maintaining a healthy credit score.

Make sure that the information on your credit report is correct and up to date. As we have seen in this case with Equifax, you should also be checking your credit reports to see who is looking into your credit. Each inquiry into your credit is viewed as you applying for credit, and too many inquiries can hurt your credit score.

If there is information on your credit report that should not be there, make sure you dispute it with the credit reporting agency right away.

If the credit reporting agency fails to look into your dispute, or do not correct your information, you may be entitled to damages. If this is happening to you, you can Get a Free Case Review, and a representative from Francis Mailman Soumilas, P.C. will be in touch.